Not a great book, basically because it provides no insights at all. It just tells you a simple story of a company called Value America which promised to change the e-commerce landscape, but ends up bankrupt.

But it gives you a picture of how a whole industry gets into a bubble.

Value America promised the world this :

- An inventoriless e-commerce architecture which would sell everything from a Colgate toothbrush to an iMac on its website.

- No inventory will mean low costs resulting in lowest prices

- The e-commerce architecture will be built in such that it will be portable and potentially will run all shopping sites in the world

- With more and more people becoming netizens, Value America will get to be bigger than WalMart one day.

When someone pitches you such a proposal and you happen to have a million dollars in your bank, it is a no-brainer. And when a born salesman like Craig Winn sold such an idea, people like

Paul Allen were ready to put in their millions. But things could go wrong and how:

- You have to execute it well. When people dont get what they pay for or when they get the wrong product, they are not going to come back again

- Agency costs of Free Cash Flows is to be expected. Dont freak out !! Once in a while, I have to remind people I am an MBA. What that means is, when you have cash and lot of it, you dont necessarily have to spend it on the most productive stuff

- One crazy leader/visionary, who has dreams of the White House, cannot have a free run investing people's hard earned money.

- You cannot buy a jet for a company which making losses

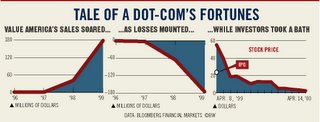

- Using revenue growth as the only signal to showcase the company's future is dangerous. After all, you can buy sales. VUSA was buying just 1% Gross Margin (The difference between what you charge the customer for a product and what you paid for the product) !!

The dream that Value America sold is still alive. The problem was not with the logic of the idea : It was too convincing that everyone wanted to bet his money on it !!

Can Google do a Value America ? Some people seem to believe so !!

But as I see it there are some similarities and differences :

- Google too is promising something inventoriless and no marginal costs

- Post IPO, GOOG has had a dream run

- But, Google is showing good profits, and growing at a mind blowing pace

- It is run by arrogant (?!) visionaries

- It is spending money on stuff like 5 Star Chefs and of course, jets

For press coverage of the Value America Story:

- BusinessWeek: The Fall of a Dot-Com

- Washington Post: The Rise and Fall of Value America